Overview

Overview of The year 2016

CHF billion

CHF million

Operating income (EBIT) 2016THE MOST IMPORTANT EVENTS OF 2016

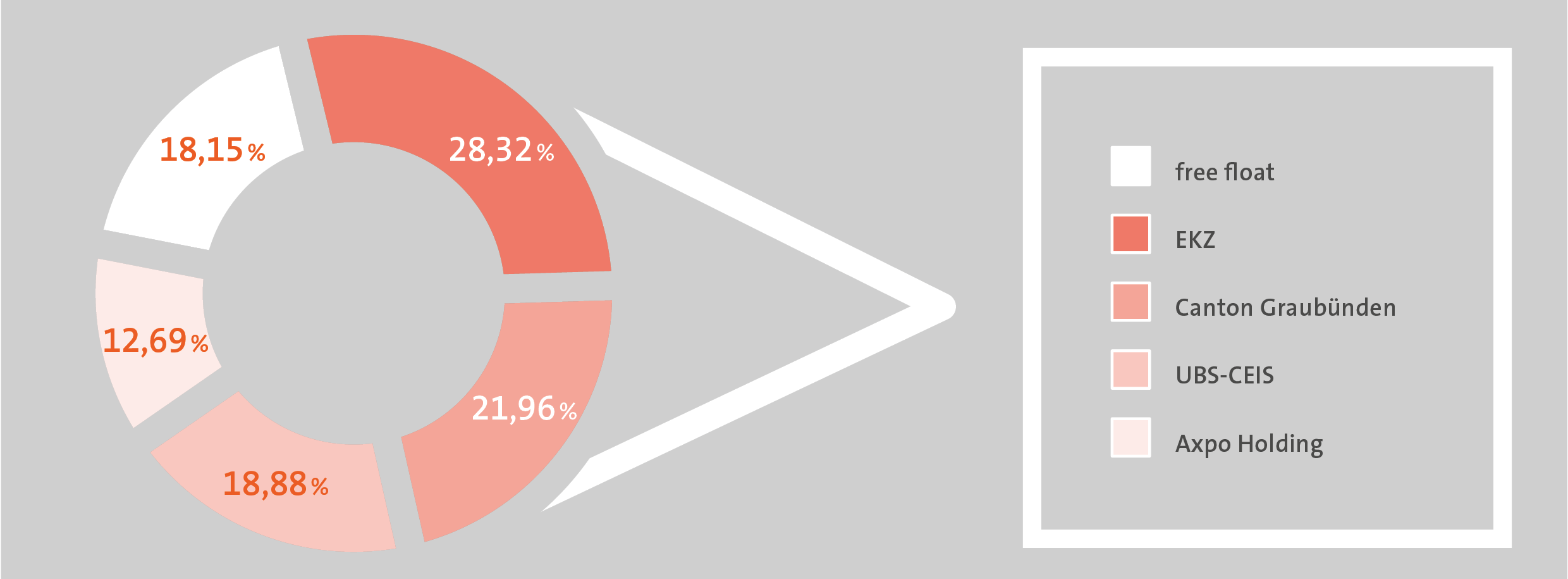

- Last year Repower increased its capital by CHF 171 million and extended its shareholder structure. The shareholders are now as follows: Elektrizitätswerke des Kantons Zürich (EKZ) 28.32%, Canton Graubünden 21.96%, UBS Clean Energy Infrastructure KGK (UBS-CEIS) 18.88%, Axpo Holding AG (Axpo) 12.69%, free float 18.15%.

- Repower also had its securities delisted from the SIX Swiss Exchange and introduced a unified registered share in place of bearer shares and participation certificates. These registered shares are traded over the counter on Berner Kantonalbank’s OTC-X platform.

- In 2016 Repower positioned itself even more firmly as a sales and service organisation. Examples of this orientation are the numerous energy services it provides to other energy utilities, and the official market launch of the Plug’n Roll electric vehicle charging network.

- In the year under review Repower was able to take Repartner Produktions AG, the production investment company it has established, a decisive step further: from 2017 the ten energy utilities involved will take around 240 gigawatt hours of electricity per year from four hydropower plants in the Prättigau.

- Finally, it should also be mentioned that in 2016 Repower completely renewed the Morteratsch power plant near Pontresina in record-quick time. For this project Repower devised an innovative financing and operating model and entered into partnership with an infrastructure fund.

Financial highlights

|

|

2016 |

2015 |

2014 |

2013 |

2012 |

|

|

|

Restated* |

|

|

Restated |

|

CHF million |

|

|

|

|

|

|

Revenue and income |

|

|

|

|

|

|

Total operating revenue |

1,740 |

1,890 |

2,273 |

2,365 |

2,372 |

|

Income before interest, taxes, depreciation and amortisation (EBITDA) |

52 |

41 |

77 |

74 |

148 |

|

Depreciation/amortisation, impairment and reversal of impairment |

–31 |

–109 |

–51 |

–224 |

–65 |

|

Income before interest and taxes (EBIT) |

22 |

–69 |

26 |

–150 |

83 |

|

Group result |

–13 |

–136 |

–33 |

–152 |

31 |

|

|

|

|

|

|

|

|

Balance sheet |

|

|

|

|

|

|

Balance sheet total at 31 December |

1,705 |

1,828 |

2,126 |

2,043 |

2,302 |

|

Equity at 31 December |

763 |

600 |

766 |

805 |

957 |

|

Equity ratio |

45% |

33% |

36% |

39% |

42% |

|

|

|

|

|

|

|

|

Further key figures |

|

|

|

|

|

|

Energy gross margin |

195 |

178 |

240 |

255 |

351 |

|

Economic value added |

–33 |

–112 |

–57 |

–188 |

–29 |

|

Operating cash flow |

69 |

17 |

98 |

69 |

54 |

|

Net debt |

41 |

270 |

234 |

328 |

365 |

|

Net debt |

0,5 |

4,5 |

2,6 |

2,6 |

2,5 |

|

FFO / Net debt |

55% |

4,1% |

26,8% |

25,4% |

24,4% |

|

CAPEX** |

24 |

24 |

28 |

53 |

114 |

|

Headcount (FTE) |

563 |

632 |

666 |

707 |

746 |

* See «Correction of errors and changes in presentation» section

** Includes investments in tangible assets, intangible assets and associates, and loans for investment purposes

Stock statistics

There was a fundamental change in Repower’s capital structure in 2016. More information can be found in the footnotes to the tables.

|

Share capital to 22 May 2016 1 |

2,783,115 |

shares |

at CHF |

1.00 |

CHF 2.8 million |

|

|

625,000 |

participation certificates (PC) |

at CHF |

1.00 |

CHF 0.6 million |

|

Sharecapital from 23 May 2016 1 |

3,408,115 |

registered shares |

at CHF |

1.00 |

CHF 3.4 million |

|

Share capital from 5 July 2016 bzw. 14.7.2016 2 |

7,390,968 |

registered shares |

at CHF |

1.00 |

CHF 7.4 million |

|

|

|

|

|

|

|

|

Prices (CHF) on SIX Swiss Exchange and OTC-X, Berner Kantonalbank 3 |

|

2016 4 |

2015 |

||

|

Bearer share |

|

|

High |

55 |

118 |

|

|

|

|

Low |

36 |

55 |

|

Participation certificates |

|

|

High |

56 |

95 |

|

|

|

|

Low |

36 |

55 |

|

|

|

|

|

|

|

|

Prices (CHF) on OTC-X, Berner Kantonalbank |

|

2016 |

2015 |

||

|

Registered share |

|

|

High |

57 |

‐ |

|

|

|

|

Low |

41 |

‐ |

1 On 23 May, Repower AG bearer shares and participation certificates were converted into registered shares on a one-for-one basis.

2 At the extraordinary general meeting on 21 June 2016, Repower AG shareholders approved the motion of the Board of Directors to increase the company’s capital. This was done by means of a rights issue consummated on 5 July and 14 July 2016.

3 Repower AG bearer shares and participation certificates were delisted from the SIX Swiss Exchange on 29 April 2016. Since 29 April 2016, Repower AG securities have been traded over the counter on Berner Kantonalbank’s OTC-X platform.

4 Information is for the period from 1 January to 23 May 2016, in other words from the start of year to the date the registered shares were introduced.

|

Dividend (CHF) |

2016 1 |

2015 |

2014 |

2013 |

|

|

|

|

|

|

|

Bearer share 2 |

0.00 |

0.00 |

0.00 |

2.00 |

|

Participation certificate (PC) 2 |

0.00 |

0.00 |

0.00 |

2.00 |

1 2016 dividend subject to decision by the Annual General Meeting. There are no restrictions on transferability or voting rights.

2 Since 24 May 2016 registered shares

REPOWER’S SHAREHOLDER STRUCTURE

Headcount

|

at 31 December |

2016 |

2015 |

|

|

|

|

|

Switzerland |

423 |

446 |

|

Italy |

159 |

159 |

|

Romania |

|

30 |

|

Czech Republic |

1 |

21 |

|

Total* |

583 |

656 |

|

|

|

|

|

Trainees |

30 |

30 |

|

Sales consultants Italy |

582 |

465 |

* For the numbers in full-time equivalents (FTEs) see table "Financial highlights" above on this page.