Overview

THE YEAR 2018

2.1

billion francs

35

million francs

operating income (EBIT) in 2018THE MOST IMPORTANT EVENTS

- Repower recorded a gratifying business result, with total operating revenues of 2.1 billion francs and EBIT of 35 million francs.

- To some extent Repower was already able to take advantage of improved conditions on the market when it came to capitalising on its assets.

- In 2018 Repower continued to follow through on its promise of “made by the pros for the pros” to acquire very attractive work from third parties.

- The annual general meeting held on 16 May 2018 elected Dr Monika Krüsi as the new chair of the board of directors.

- The beginning of December saw the creation of the Italian subsidiary Repower Renewable, which considerably increases Repower Italy’s interests in renewable electricity generation assets. The Repower Renewable portfolio comprises hydropower, solar and wind power installations.

- Repower Italy has designed a new, completely digital distribution channel which now enables customers to get a flat quote for electricity and gas packages.

- The company continues to drive the electro-mobility theme forward in Switzerland and Italy. New partnerships, product innovations and tools, and gratifying sales figures, confirm the importance of electric vehicle-related services.

- At the end of 2018 the Customer Value Centre, a centre of competence designed to serve as a single point of contact, went into operation. It enables Repower to give its customers an optimised experience and channel their needs even more effectively.

- In the Landquart area Repower dismantled 13 electricity pylons and constructed a new underground cable line. The new line is higher-capacity and easier to maintain, as well as returning the landscape to its original state.

- Despite a technical failure, the performance of the Teverola power plant in Italy was well above expectations.

FINANCIAL HIGHLIGHTS

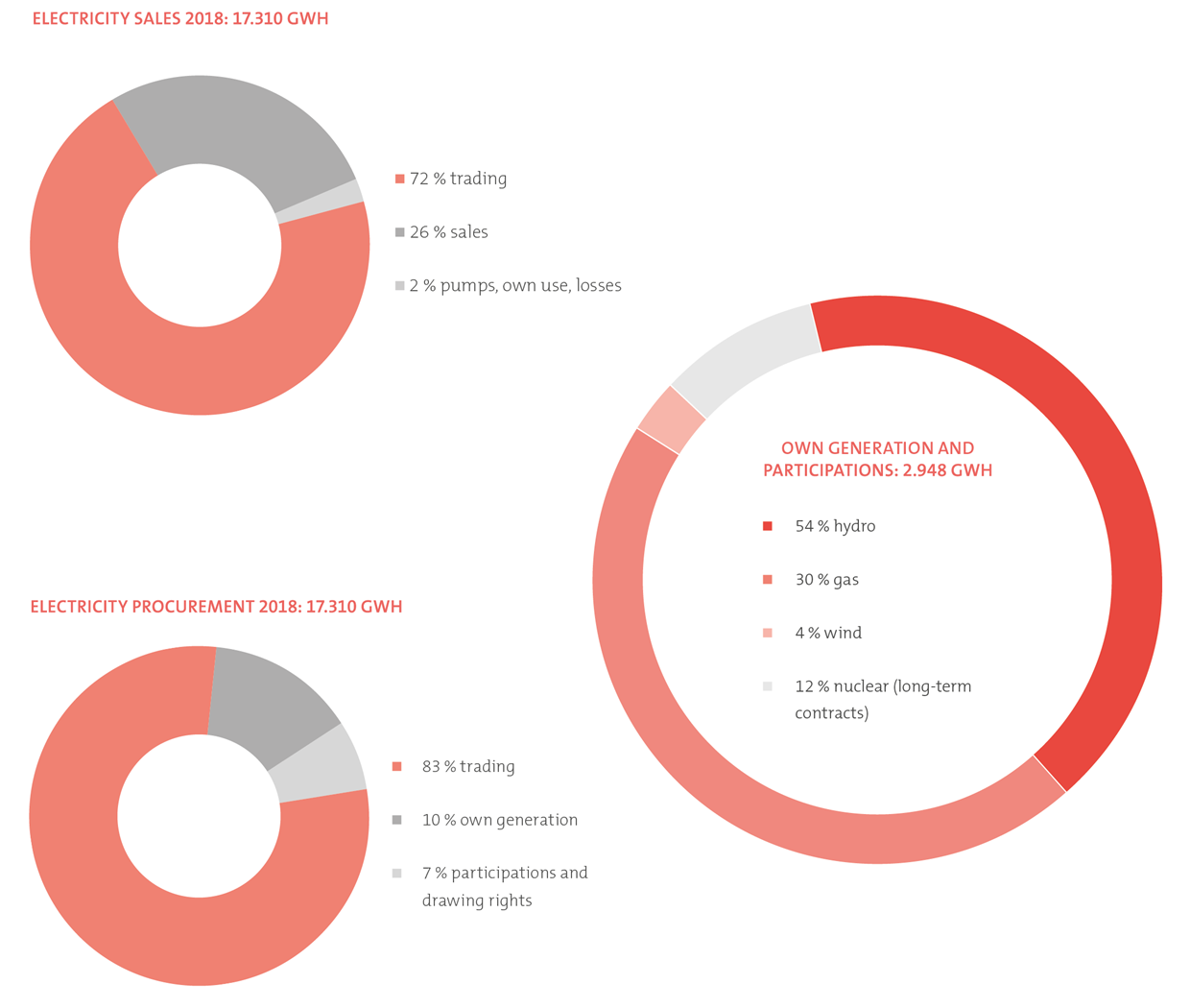

ENERGY BALANCE SHEET

STOCK STATISTICS

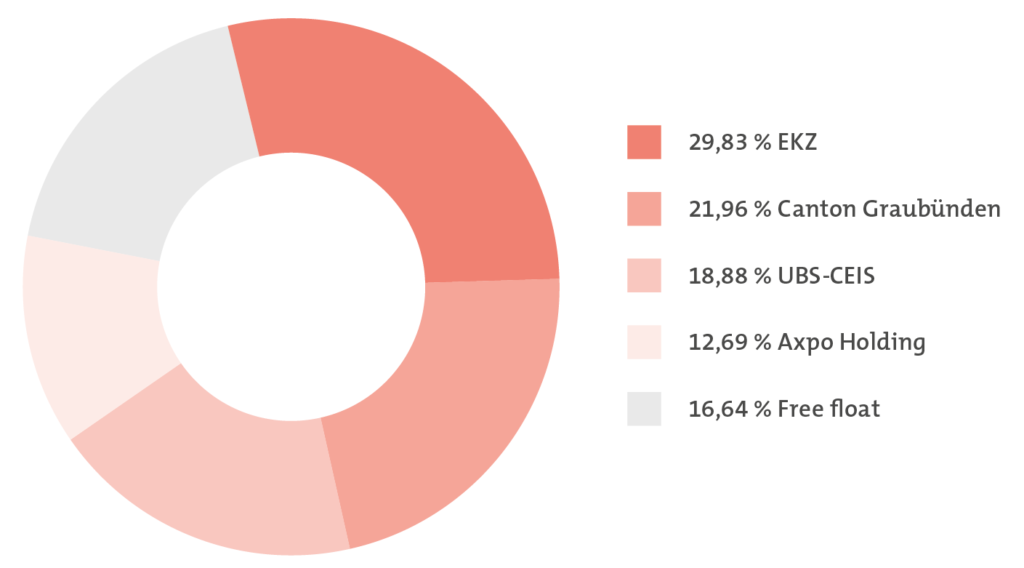

REPOWER’S SHAREHOLDER STRUCTURE

HEADCOUNT