Governance

This section complies with the principles set down in the Swiss Code of Best Practice for Corporate Governance, and contains key information on corporate governance in the Repower Group. The information is also available on the www.repower.com/governance website.

Basic principles

The principles of corporate governance are laid down in the articles of association and in the organisational regulations and related assignment of authority and responsibility (available at www.repower.com/governance). The board of directors and executive board regularly review these principles and revise them as and when required. The organisational regulations and the assignment of authority and responsibility were reviewed in the year under review and approved by the board of directors on 30 March 2017 and 11 September 2017 respectively.

Group structure and shareholders

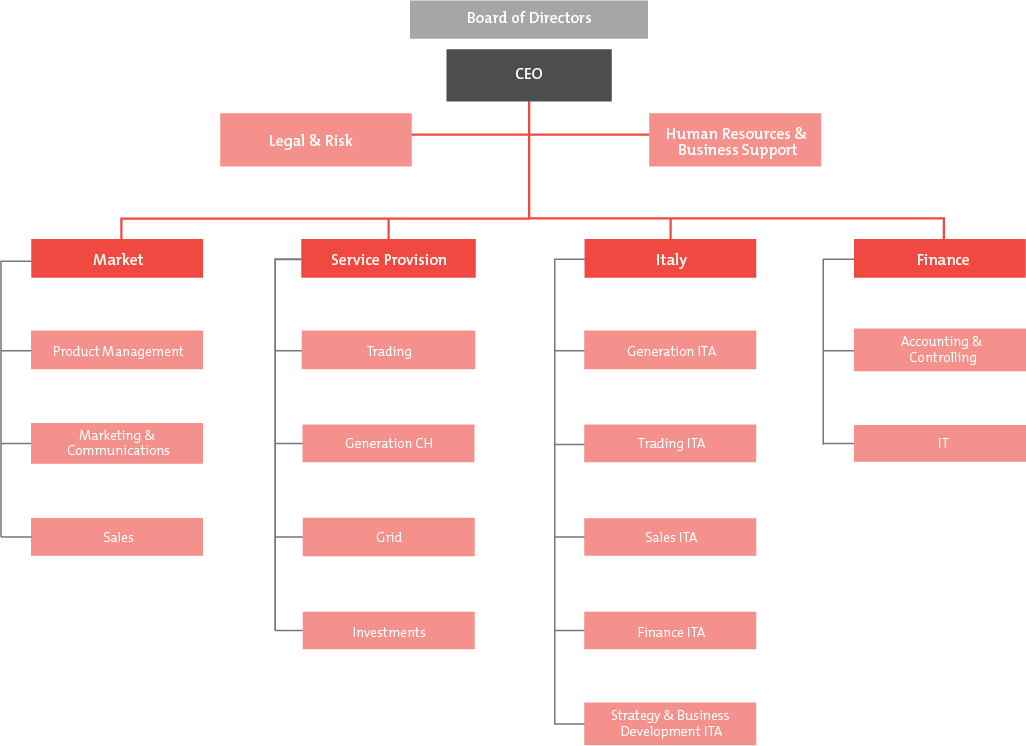

The Repower Group consists of Repower AG and its holdings. The registered office of Repower AG is in Brusio in Canton Graubünden, and its postal address is Via da Clalt 307, 7742 Poschiavo. Repower AG is an international energy company based in Switzerland. The group operates along the entire electricity value chain (generation, trading, transmission, sales and distribution) and draws on its deep energy expertise to offer its services to other customers and deliver contracts for third parties. The group also operates in the gas business. The Repower Group employs around 600 people. The operational group structure comprises four divisions – Service Provision, Market, Italy, and Finance – plus two administrative units reporting direct to the CEO (see the diagram below showing Repower’s organisation as of 31 December 2017).

The Service Provision division comprises the Generation Switzerland, Trading and Grid (Basic Supply) units and Repower’s interests. It brings together all functions connected with the management of assets and the provision of the products and services sold by the Market division.

The Market division comprises the Product Management, Market & Communications and Sales units. The role of this division is to design, manage, market, distribute and sell services and products. Active key account management is in place for the energy utility customer segment. This division is also responsible for basic supply activities and the sales business in Switzerland and Germany.

The Italy division is in charge of sales of electricity, natural gas and green power certificates to end-consumers, and the operation and maintenance of generation facilities in Italy.

The Finance division manages finance and controlling and IT activities. The treasury and real estate departments also operate within this division.

The Human Resources & Business Support and Legal & Risk units report directly to the CEO.

The individual operations are managed centrally by Repower AG and are not organised into separate legal structures. However, if management by Repower AG is deemed impossible or inefficient for legal, fiscal or regulatory reasons, or if new legal entities are added (for example through acquisition), management is handled by legally independent subsidiaries. An overview of shareholdings can be found here.

Repower AG registered shares are traded on Berner Kantonalbank’s OTC-X platform. In addition, Repower securities are available on the Zürcher Kantonalbank and Lienhardt & Partner platforms.

Elektrizitätswerke des Kantons Zürich (EKZ) currently holds 29.83 per cent, Canton Graubünden 21.96 per cent, UBS Clean Energy Infrastructure KGK 18.88 per cent and Axpo Holding AG 12.69 per cent of the shares; together they thus hold 83.36 per cent of the voting rights. In a transaction on 4 October 2017, EKZ acquired 111,685 Repower registered shares from the free float. This increased EKZ’s holding from 28.32 per cent to 29.83 per cent. The anchor shareholders are committed to one another through a shareholders’ agreement. As a core provision of this agreement, the parties agree that Repower AG shall operate as a private, independent, profit-oriented energy supply company based in Canton Graubünden managed according to business principles with broad-based activities including generation (hydropower) in Canton Graubünden and the core markets Switzerland and Italy. The shareholders’ agreement also contains limitations on transferability as well as detailed provisions governing corporate governance.

No cross-shareholdings exist. The remaining 16.64 per cent of the unified registered shares are in free float.

Capital structure

The share capital of Repower AG (information on the capital supplementary to the balance sheet is given in the overview of changes in consolidated shareholders’ equity) consists of 7,390,968 registered shares (Swiss securities no. 32 009 699) each with a par value of CHF 1. Each registered share entitles the holder to one vote at the annual general meeting. The registered shares have a dividend entitlement. There are no preferential rights or restrictions on voting rights. No authorised or conditional capital exists. Repower AG has no outstanding dividend right certificates. Repower AG has issued no convertible bonds, options or other securities that entitle the holders to shares in Repower AG. Based on the stock exchange prices for the registered shares, the company had a market capitalisation of CHF 499 million at the end of 2017.

Board of directors

Members

The members of the board of directors are listed in the “Members of the board of directors” section. No member of the board of directors of Repower AG performs operational management tasks for the company. Members of the board of directors do not sit on the executive board of Repower AG or on that of any other group company. In the three financial years preceding the year under review, no member of the board of directors was entrusted with any executive functions within the Repower Group. Some members of the board of directors perform executive functions for Elektrizitätswerke des Kantons Zürich, UBS Clean Energy Infrastructure KGK or Axpo Holding AG – all anchor shareholders – or their affiliated companies. Normal business relations exist with these companies.

Election and term of office

The members of the board of directors are elected annually by the annual general meeting individually or together. The term of office ends with the completion of the next annual general meeting. Newly elected members complete the terms of office of their predecessors. The board of directors currently comprises seven members, the maximum permissible number under the articles of association. Re-election is possible. Under the terms of the organisational regulations, members of the board of directors must give up their seats on the board as a rule at the annual general meeting following the end of the year in which they reach age 70. The board of directors may make exceptions to this rule.

Internal organisation

The board of directors determines its own internal organisation. It elects its chairman, vice chairman and secretary; the secretary need not be a member of the board of directors. There is also an audit committee and a personnel committee. Members of the committees are elected for the same term of office as the board of directors. The members of the audit and personnel committees are detailed in the “Members of the board of directors” section. These two committees prepare business for the board of directors and provide the board of directors with periodic reports on their activities in a suitable format. They do not have decisionmaking powers.

Together with the secretary and the CEO, the chairman of the board of directors draws up the agenda for meetings of the board of directors. Members of the board of directors generally receive proposals relating to each agenda item eight days in advance of meetings. These proposals include background information as well as an evaluation and a motion by the executive board and by the committees. The board of directors meets at the invitation of the chairman or, if the latter is not available, of the vice chairman, as often as required to conduct its business, but at least twice a year. The board of directors generally meets at least once a quarter. The board of directors must be convened whenever one of its members or the CEO makes a written request to this effect, stating the reason.

The CEO and CFO generally attend every meeting of the board of directors. The other members of the executive board attend the meetings as and when required in order to explain the proposals. The board of directors basically constitutes a quorum if the majority of its members are present. The board of directors passes resolutions by a majority vote. The chairman does not have a casting vote. Minutes are taken of the business and resolutions of the board of directors and are submitted to the board for approval at its next regular meeting.

The committees and the board of directors follow the same procedures in terms of convocation, procedure of the meetings and decisionmaking.

In the year under review the board of directors met nine times, and the committees twelve times. Meetings of the bodies normally last half a day.

Audit committee

The audit committee evaluates the efficacy of the external audit and the functional effectiveness of the risk management processes. It can engage the external auditor or other external advisors to perform special audits for the purpose of internal control. The audit committee also reviews the status of company compliance with various standards (annual compliance report). The committee inspects the individual and consolidated financial statements and the interim financial statements intended for publication; it discusses the financial statements with the CFO and, insofar as this is deemed necessary, with the head of the external auditors and the CEO. Finally, it also decides whether the individual and consolidated financial statements can be recommended to the board of directors for submission to the annual general meeting. It evaluates the services and fees of the external auditors and verifies their independence. It also determines whether the auditing role is compatible with any consulting mandates. The audit committee evaluates the overall financing of the company and individual financing measures, the company’s medium and long-term cash planning, and its liquidity and working capital management. It also evaluates the budgets, long-term financial plans and the principles used to measure non-current assets.

Personnel committee

The personnel committee oversees on behalf of the board of directors the objectives and principles of personnel policy and obtains from the CEO information on the implementation of the principles of compensation and personnel policy. Once a year the personnel committee reviews a) the CEO’s proposed appraisal of the members of the executive board (including compensation) and corresponding measures for the attention of the board of directors and b) the CEO’s proposed objectives for the members of the executive board and submits them (including objectives and pay adjustments for the CEO) to the board of directors for approval. The personnel committee obtains from the CEO information on personnel development (including succession planning) at management level and the corresponding measures at executive level. It evaluates and discusses the company’s and group companies’ compensation guidelines and schemes and reviews their efficacy, attractiveness and competitiveness. The committee sets down the principles for selecting candidates for the executive board, oversees the selection procedure in line with these principles and evaluates, with the CEO, the candidates for the nominations to be made by the board of directors for membership of the executive board. The personnel committee prepares re-elections and new elections within the board of directors, taking account of the shareholder structure. It also reviews appropriate insurance policies for members of the board of directors and executive board, and proposes any necessary modifications to the board of directors.

Assignment of authority and responsibility to the board of directors and executive board.

Types of authority granted to the board of directors and the executive board are defined in the organisational regulations and the related assignment of authority and responsibility. The board of directors is responsible for the overall direction and strategic orientation of the Repower Group and for supervising the executive board. It reviews and determines on an annual basis the objectives and strategy of the Repower Group as well as the corporate policy in all sectors, and makes decisions regarding short- and long-term corporate planning. It also deals with the organisational structure, accounting structure, internal control system and financial planning, the appointment and discharge of the persons entrusted with management and representation (namely the CEO, deputy CEO and the other members of the executive board), preparation of the annual report, preparations for the annual general meeting and implementation of its resolutions, passing resolutions on capital increases and the resulting amendments to the articles of association, examining the qualifications of specially qualified auditors in the instances provided for under the law, and making decisions on compensation policy. The board of directors has delegated the entire operational management of the Repower Group to the CEO. The CEO has delegated certain management functions to the members of the executive board. Some types of business or transactions must be presented to the board of directors for a decision in accordance with the assignment of authority and responsibility (annex to the organisational regulations).

Information and control instruments vis-à-vis the executive board

At each meeting of the board of directors, the CEO and the members of the executive board report on current business developments, important business transactions and the status of major projects. Aside from these meetings, any member of the board of directors may ask the CEO to provide information about the course of business and also, if the chairman agrees, about individual transactions. Supervision and control of the executive board is handled by approving the annual planning and on the basis of detailed quarterly reporting comparing actual and target figures. Quarterly reporting includes data on the volumes of energy sold and procured, the income statement and balance sheet (including expected values for the most important key figures, namely energy sales, total operating revenue, operating income, profit, cash flow, capital expenditure, property, plant and equipment, total assets, equity, economic value added), energy trading risks (market risks and counterparty risks) and key projects. Important key figures on the Swiss and Italian markets, trading and the Corporate Centre also form part of the quarterly reporting. The Repower Group also does segment reporting in accordance with Swiss GAAP FER 31 (for more information, see the section on segment reporting). The board of directors also receives quarterly progress reports and final performance reports on key projects, as well as – if specifically requested – status reports on individual business activities. Annual and long-term planning covers corporate objectives, key projects and financial planning. In addition there are risk management and auditors’ reports to facilitate the assessment of management and the risk situation. Repower has a risk management system which is described in detail in a policy issued by the board of directors. At the end of each year the board of directors defines the risk strategy for the following financial year. Significant risks must be brought to the attention of the board of directors at least once a year, with quarterly updates to advise the board of directors of any changes in these risks. The auditors draw up a comprehensive report once a year documenting the key findings of their audit.

Repower Group Executive Board

Kurt

Bobst

CEO (Chairman of the Executive Board of Repower Group)

Felix

Vontobel

Head of Service Provision, Deputy CEO

Stefan Kessler

CFO (Head of Finance Division) to 31 January 2017

Brigitte Krapf

CFO (Head of Finance Division) from 1 February 2017

Fabio

Bocchiola

Head of Italy

The list in the “Executive board” section provides detailed information on members of the executive board (name, age, position, nationality, date of joining the company, professional background, and other activities and interests). No management tasks were transferred to third parties.

Compensation, shareholdings and loans

Content of compensation and procedure for setting compensation

On 31 December 2017 the board of directors consisted only of non-executive members. Under the terms of the articles of association the board of directors sets the annual compensation paid to its members. The members of the board of directors receive compensation based on the work they have performed and their responsibilities in accordance with the remuneration rules. The board of directors was compensated in accordance with the remuneration rules of 21 July 2016. The compensation consists of a flat fee that already covers any out-of-pocket expenses. This compensation does not depend on the company’s earnings.

The compensation paid to members of the executive board comprises a fixed and a variable component. The fixed component consists of the base salary, and can also contain other compensation components and benefits. Depending on achievement of operational targets, the variable component may amount to a maximum of 40 per cent of the annual base salary. The fixed and variable components are set on an annual basis by the personnel committee and approved by the board of directors. The fixed component is based on a proposal made by the CEO on the basis of the development of the group. The variable component depends on achievement of the Repower Group’s financial targets and the member’s personal performance targets. The bonus targets are weighted as follows: 40 per cent measured by profit and 40 per cent measured by economic value added (EVA). For each member of the executive board, between two and a maximum of four personal performance objectives are set, which are likewise weighted 20 per cent to calculate the bonus.

The CEO submits his proposal for the variable components for each individual member to the personnel committee. The board of directors then makes the final decision. Personal performance is evaluated in a meeting with the CEO at the end of the reporting period on the basis of the objectives agreed at the beginning of the financial year. All compensation components are paid in cash. No external advisors were involved in designing the compensation system.

Compensation paid to members of the board of directors

In the year under review the members of the board of directors received cash compensation in the amount of CHF 704,176 (prior year: CHF 685,790). Compensation breaks down in detail as follows:

Compensation paid to the members of the executive board

In the year under review the members of the executive board received cash compensation in the amount of CHF 2,687,287 (prior year: CHF 2,966,821). Compensation breaks down in detail as follows:

Shareholders’ rights of participation

Shareholders’ rights to assets and participation are in accordance with the law and the articles of association. None of the provisions of the articles of association deviate from statutory provisions, with the exception of the placement of an item of business on the agenda of the annual general meeting. To do so, a shareholder or several shareholders must hold at least CHF 100,000 of share capital and submit a written request at least 50 days prior to the annual general meeting.

One shareholder or several shareholders who together hold at least 10 per cent of the share capital may request in writing that an extraordinary general meeting be convened, provided that the request states the proposals and the item of business. An ordinary general meeting of shareholders takes place every year, no more than six months after the end of the financial year.

Each shareholder may be represented at the annual general meeting by granting another shareholder authority in writing or by granting the independent proxy authority in writing or electronically. Each share entitles the holder to one vote at the annual general meeting.

Auditor

Since 2015, Ernst & Young AG, Zurich, Switzerland, has served as the statutory auditor and group auditor appointed annually by the annual general meeting. The former auditor-in-charge, Alessandro Miolo, was responsible for the engagement from that time. Because of a change of job, at the end of October 2017 Alessandro Miolo handed over responsibility for the engagement to the new auditor in charge, Willy Hofstetter. Ernst & Young AG was paid a total fee of TCHF 586 for its auditing services for the group in the 2017 financial year and TCHF 54 for other consulting services.

Supervision and control instruments vis-à-vis the auditors

The audit committee monitors the credentials, independence and performance of the auditor and its audit experts. It obtains information at least once a year from the audit managers and the executive board concerning the planning, execution and findings of the audit work. The audit committee asks the auditors to provide the audit plans and any proposals for improving internal controls. The auditors draw up for the board of directors a comprehensive report with findings on accounting practices, internal controls, the execution and results of the audit. The items and improvements discussed in the report are reviewed by the auditors in an interim audit and the results are presented to the audit committee. In 2017 representatives of the external auditor participated in three meetings of the audit committee.

Information policy

The Repower Group provides its shareholders, potential investors and other stakeholders with comprehensive, timely and regular information in the form of annual and semi-annual reports, at the annual press conference and the annual general meeting of shareholders. Important developments are communicated via news releases (link to request news releases by e-mail: www.repower.com/subscribe-to-newsreleases). The website www.repower.com, which is regularly updated, serves as an additional source of information.

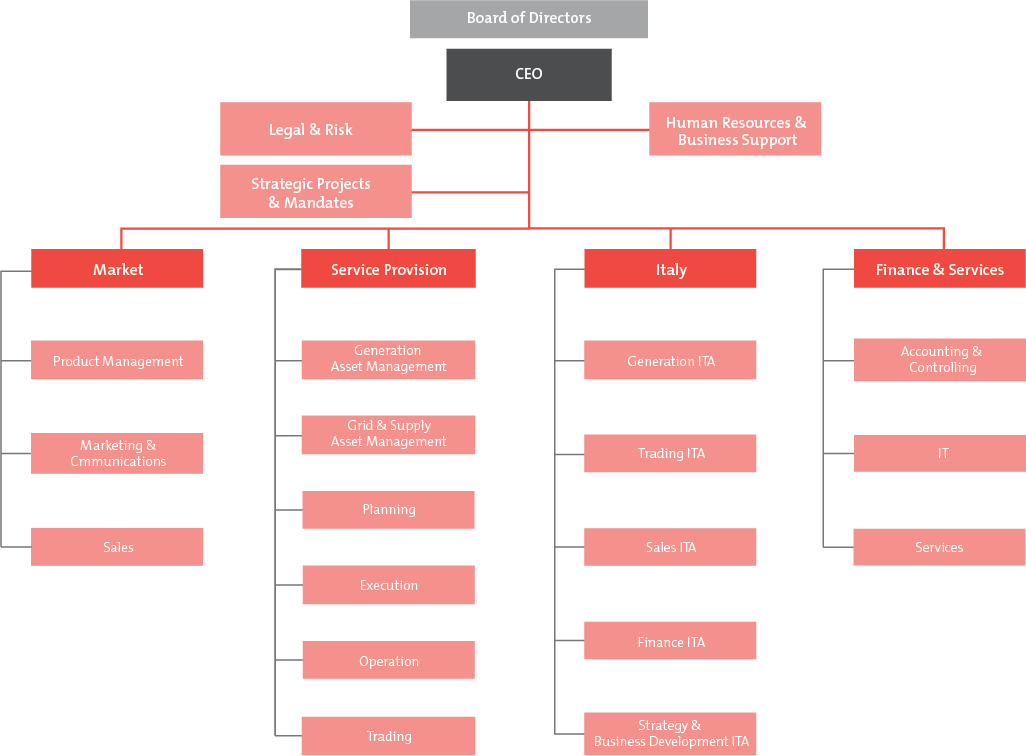

Events after the balance sheet date

On the basis of the new strategic realignment, the Service Provision unit was reorganised and the organisation modified accordingly, with the changes taking effect on 1 January 2018.

At an extraordinary meeting of the board of directors on 18 September 2017, Samuel Bontadelli was elected as new Head of Service Provision to succeed Felix Vontobel on 1 January 2018.

In a media release on 25 January 2018 it was announced that Dr Pierin Vincenz, chairman of the board of directors of Repower, would no longer be standing for re-election at the AGM in May 2018.